Professional Liability (E&O) Insurance for Service-Driven Businesses

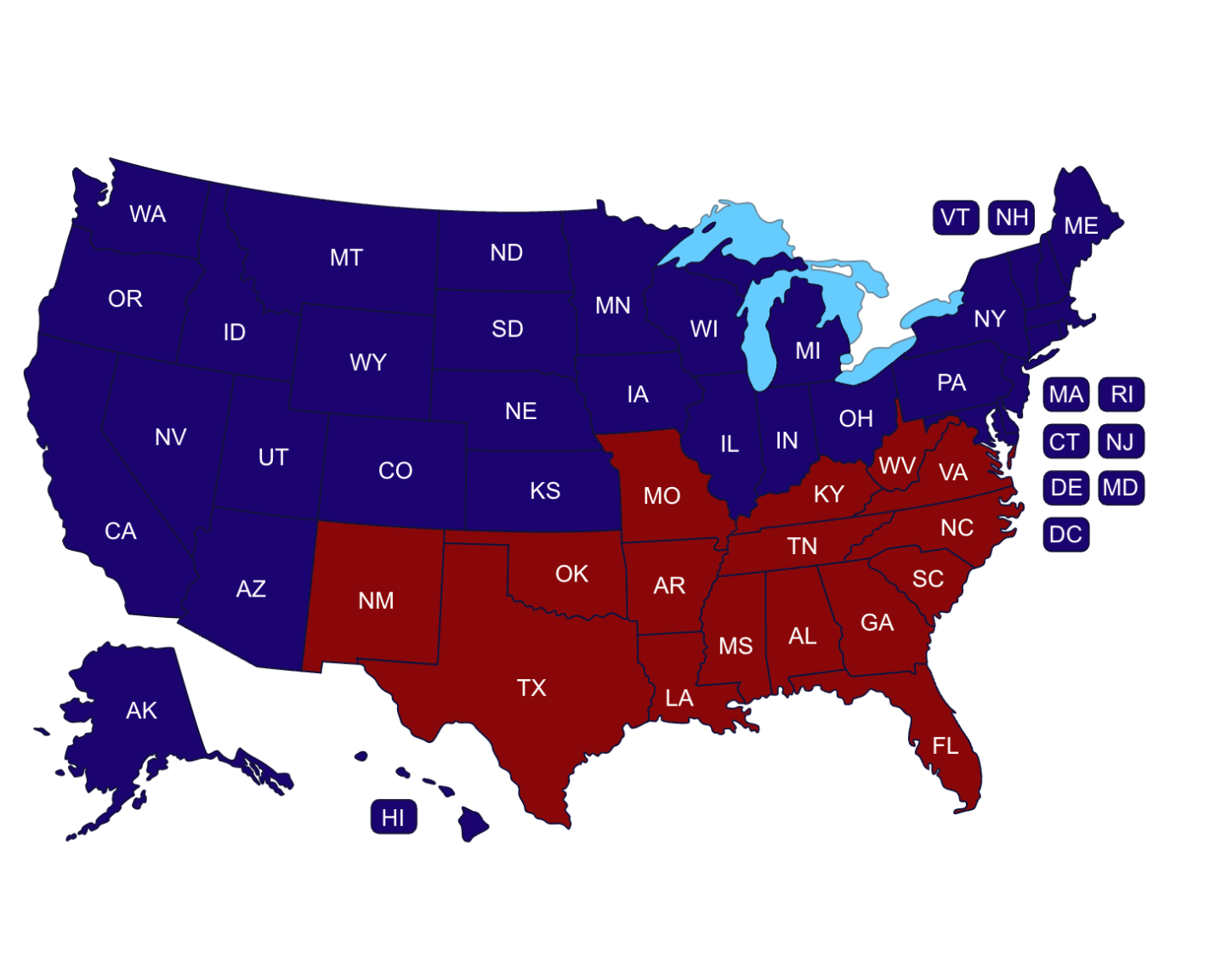

Protect your company from costly claims alleging professional mistakes, negligence, or failure to deliver services. Our Professional Liability (E&O) programs support companies across Georgia, Florida, Alabama, Tennessee, Texas, North Carolina, and South Carolina — with Georgia representing the majority of our long-term E&O clients.

Professional Liability Insurance — also known as Errors & Omissions (E&O) — protects businesses when clients allege that your services caused financial harm. Even highly skilled professionals can face claims involving:

– Mistakes or oversights

– Miscommunication

– Missed deadlines

– Negligence allegations

– Failure to deliver contracted work

In a multi-state environment with high client expectations, Professional Liability coverage is essential.

Whether you operate in Georgia, Tennessee, the Carolinas, Florida, Alabama, or Texas, a single allegation can pose a major threat to your cash flow and reputation.

E&O Protects You From:

– Alleged professional negligence

– Errors or omissions in your services

– Failure to deliver services

– Contract disputes over performance

– Client financial loss

– Incorrect advice or recommendations

Without E&O insurance, your business may be responsible for legal fees, court costs, settlements, and damages.

Core E&O Protection Includes:

– Legal defense costs (even if a claim is unfounded)

– Alleged errors or professional mistakes

– Failure to deliver contracted services

– Incorrect consulting/advice

– Missed deadlines or miscommunication

– Work product mistakes or oversights

– Client financial loss caused by your service

Professional Liability is essential for service-based and advisory businesses. We support organizations across the Southeast in industries including:

– Consultants & advisory firms

– Accounting & financial firms

– Real estate & property management

– Marketing & creative agencies

– Technology & SaaS businesses

– Healthcare & medical practices

– Insurance professionals

– Staffing & recruiting firms

– Legal support services

– Construction consultants & inspectors

States such as Georgia, North Carolina, Tennessee, and Florida historically experience strong E&O claims activity.

We design tailored E&O programs based on your operations, exposure, and regional footprint across the Southeast.

We review your services, contracts, processes, and operational exposure.

Coverage is structured around your liability risks across Georgia and surrounding states.

If a claim occurs, our team helps you respond quickly and effectively.

Businesses across Georgia, Florida, Alabama, Tennessee, Texas, North Carolina, and South Carolina choose us because:

– We specialize in service-based and advisory professions

– Access to top regional and national E&O carriers

– High-limit coverage options for complex risks

– Fast quoting and responsive communication

– Georgia-based leadership with full Southeast reach

Primary Market:

– Georgia

Additional States Served:

– Florida

– Alabama

– Tennessee

– Texas

– North Carolina

– South Carolina

Entire South East

We support single-state, multi-state, and regionally expanding businesses with consistent coverage and aligned risk management.

One allegation or misunderstanding should not threaten your business or reputation. Get a tailored Professional Liability (E&O) program designed for organizations across the Southeast.