Management Liability (D&O) Insurance for Organizations Across the Southeast

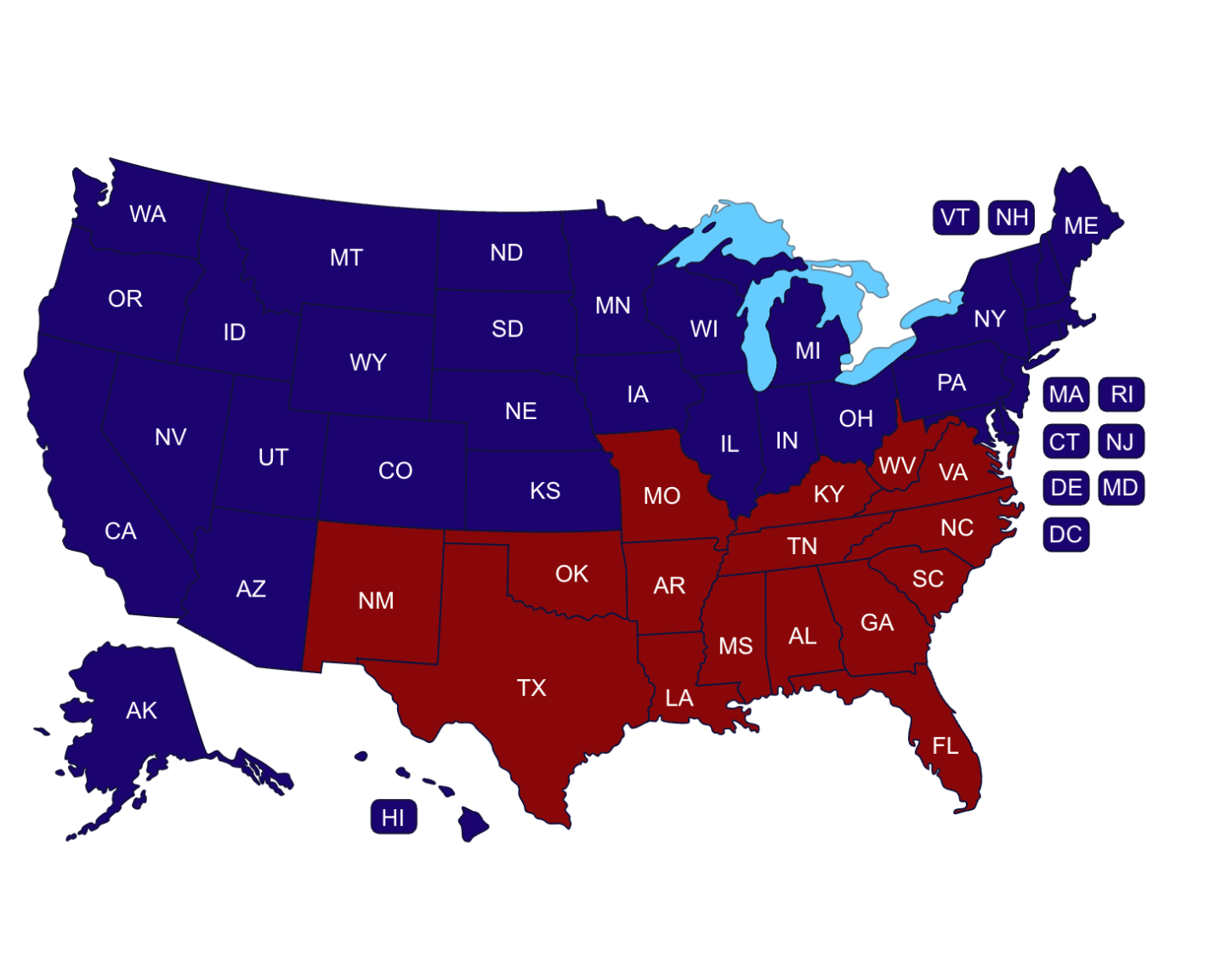

Protect your executives, board members, and organizational leadership from costly claims alleging mismanagement, breach of duty, or wrongful decisions. Our Management Liability (D&O) programs support companies, nonprofits, and public-serving organizations across Georgia, Florida, Alabama, Tennessee, Texas, North Carolina, and South Carolina — with Georgia representing the majority of our long-term D&O clients.

Directors & Officers (D&O) Liability Insurance protects corporate leaders and governing bodies from personal financial exposure when claims allege wrongful acts, mismanagement, or decisions that result in harm to stakeholders.

D&O protects against claims brought by:

– Employees

– Shareholders or members

– Vendors

– Customers

– Regulators

– Competitors

Leadership teams make critical decisions every day — hiring, firing, directing financial strategy, approving contracts and guiding company direction. In Georgia, Tennessee, Florida, the Carolinas, and Texas, litigation involving leadership decisions has increased significantly.

D&O Protects Your Leadership From Claims Alleging:

– Breach of fiduciary duty

– Corporate mismanagement

– Negligent decision-making

– Misrepresentation

– Failure to comply with regulations

– Conflicts of interest

– Errors in financial governance

Without D&O, executives may be held personally liable.

Core D&O Protection Includes:

– Legal defense costs (even for unfounded allegations)

– Wrongful act claims against directors or officers

– Allegations of mismanagement or poor oversight

– Claims brought by shareholders, employees, or regulators

– Financial damages resulting from board decisions

– Coverage for leadership at subsidiaries and affiliates

Additional Available Enhancements:

– Entity coverage

– Outside directorship liability

– Regulatory investigation defense

– Crisis event and reputation protection

D&O insurance is essential for organizations with decision-makers, boards, investors, or public exposure. We support organizations across the Southeast in sectors including:

– Private companies

– Nonprofit organizations

– Startups and growth-stage businesses

– Professional services firms

– Real estate & development companies

– Healthcare & medical practices

– Staffing & recruiting firms

– Technology & SaaS organizations

– Manufacturing & industrial companies

– Associations with boards or advisory councils

Georgia, North Carolina, Tennessee, and Florida remain key hotspots for D&O litigation.

We design D&O programs tailored to your leadership structure, governance model, financial risk, and regional footprint.

We analyze your board structure, entity type, and decision-making risks.

Coverage is structured around your organizational risk profile across Georgia and surrounding states.

If leadership faces a claim, we help you navigate defense, documentation, and best response strategies.

Organizations across Georgia, Florida, Alabama, Tennessee, Texas, North Carolina, and South Carolina choose us because:

– We specialize in leadership and governance-related risks

– Access to top D&O carriers with competitive pricing

– High-limit protection for complex corporate structures

– Fast quoting and support for board-level requirements

– Georgia-based leadership with full Southeast reach

Primary Market:

– Georgia

Additional States Served:

– Florida

– Alabama

– Tennessee

– Texas

– North Carolina

– South Carolina

We support private companies, nonprofits, boards, and executive teams across the Southeast.

Your executives and board members should never be personally financially exposed due to claims related to governance, oversight, or business decisions. Get a tailored Management Liability (D&O) program built for organizations across the Southeast.